The adoption of Bitcoin is growing steadily over time. The remarkable thing is that even Bitcoin's staunchest opponents will all come around sooner or later. It's only a matter of time. The most famous of them is Michael J. Saylor who went all Bitcoin for MicroStrategy in the summer of 2020. Since then, he has stuck to his strategy of buying Bitcoin in DCA mode.

The future will prove him right. Over the past few years, I've been fascinated to see Ray Dalio's change in attitude about Bitcoin. He didn't believe in it at all at first, and his talk has changed steadily as events have proven Bitcoiners right.

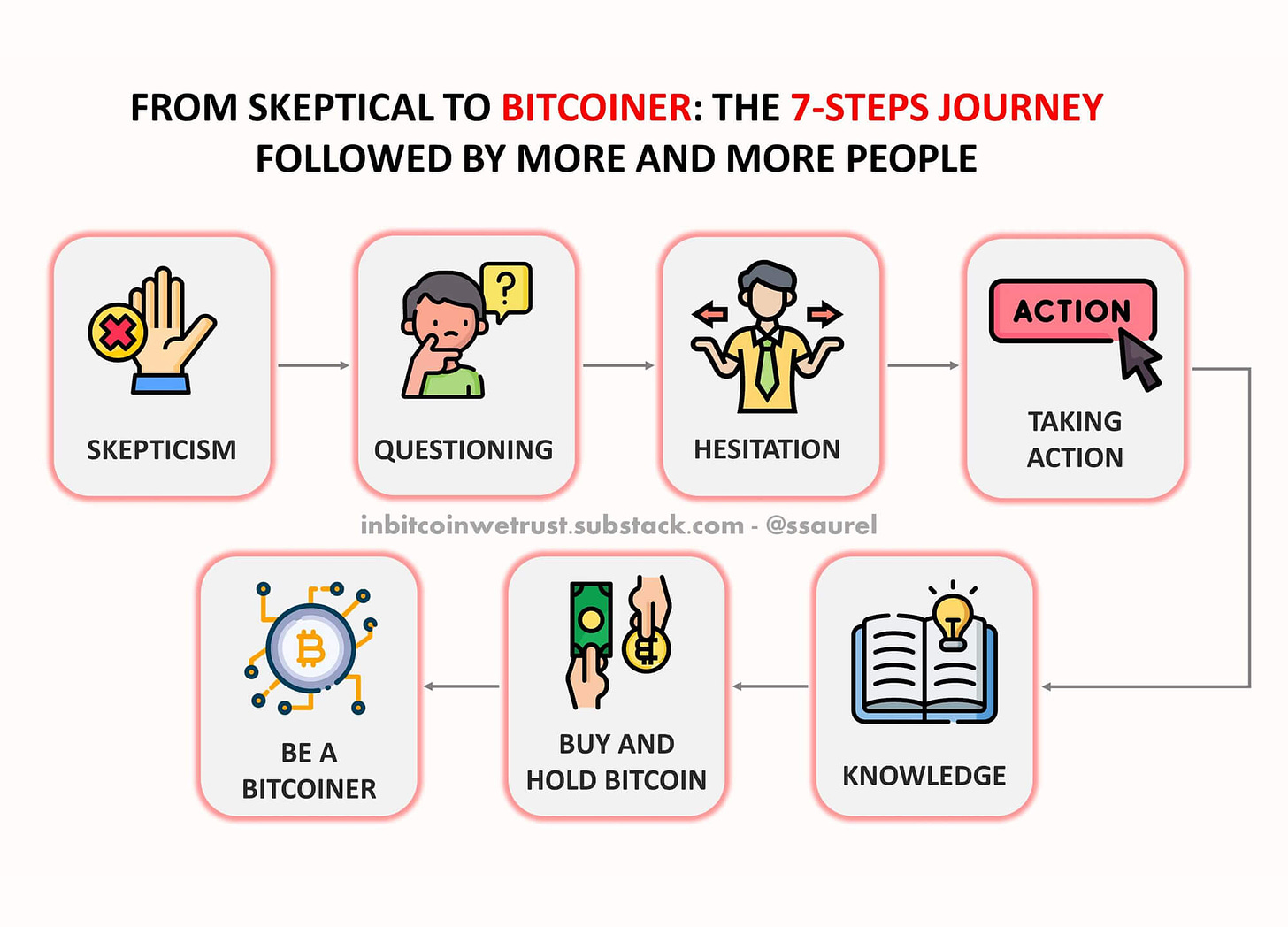

Ray Dalio is not yet a Bitcoiner, but he has bought and holds Bitcoin now. His attitude reminds me of the 7 steps of the incredible journey that takes people from skeptics to Bitcoiners. Here are the details. You'll see that you've probably been through these steps yourself and that people around you are stuck at some stage of this process.

Step 1: Skepticism

The general public generally discovers Bitcoin through the mainstream media, which rarely provide quality content. Often, the media simply denigrate Bitcoin by subjectively denouncing the associated risks.

The general public’s first contact with Bitcoin may also come from the negative statements made against it by central bankers and governments in developed countries.

Following this initial contact, the general public generally tends to adopt a skeptical stance toward Bitcoin. Indeed, since their governments tell them that Bitcoin is based on nothing, this must be true. Besides, Bitcoin is said to promote illegal activities and money laundering according to the governments of developed countries.

The first contact is therefore very negative and many people choose to put Bitcoin aside initially. This makes sense because Bitcoin is unlike anything you've ever seen before. It's in a category all its own.

Step 2: Questioning

As the economic situation in their country deteriorates, some people are asking questions. The constant inflation of the U.S. dollar is devaluing more and more what people own. Disappointed with the current monetary and financial system, some people come to question what money is and how it works.

University studies do not teach you what money is because the people who govern you, the central bankers or the economists find great interest in your ignorance.

Henry Ford once said:

“It is well enough that people of the nation do not understand our banking and monetary system, for if they did, I believe there would be a revolution before tomorrow morning.”

If too many people were to realize that the current monetary and financial system is failing, a revolution would start in each of the most developed countries.

I would like to point out, however, that the situation is slowly approaching a revolution in many countries. When it is not a revolution that is approaching, we see that many people simply no longer have confidence in the people who govern them.

Step 3: Hesitation

The questioning step leads many people to understand that Bitcoin is currently the only credible alternative for the world to the current monetary and financial system. No one says that Bitcoin is perfect but it builds block by block a fairer system for the future of the world.

People are realizing that they cannot be certain that the purchasing power of 1 USD from today will still be equal to the purchasing power of 1 USD in 2050.

Decisions by central bankers and governments to use monetary expansion as the answer to all the world’s economic problems greatly devalue what they have. Bitcoin guarantees them that 1 BTC = 1 BTC no matter what. The maximum amount of Bitcoin that can be put into circulation is 21 million and it will not change. This is a verifiable fact.

The intrinsic properties of Bitcoin protect people better than fiat currencies have ever been able to do. When you buy 1 Bitcoin, you will forever own 1 Bitcoin out of the 21 million that will be put into circulation.

Step 4: Taking Action

The Earth’s population is growing all the time. The latest estimates suggest that the Earth will have 10 billion inhabitants in 2050. If Bitcoin continues its revolution and is adopted by the general public, this will make 21 million Bitcoins for 10 billion people.

In 2050, we will therefore have the equivalent of 1 Bitcoin for every 476 inhabitants on Earth.

Owning 1 Bitcoin in 2050 will therefore put you among the richest people in the world quite simply. This possibility, therefore, pushes people to step 4 to take action by buying Bitcoin. This action often consists of buying Bitcoin for between $500 and $1,000 just in case.

In case Bitcoin becomes the revolution that many Bitcoiners keep talking about of course.

Step 5: The Deepening Of Knowledge

Once the action is taken and the first Bitcoin is in their possession, these people will deepen their knowledge of Bitcoin. This will lead them to secure their Bitcoin on a hardware wallet as they will quickly understand the following fundamental truth:

Not your keys, not your Bitcoin.

The Bitcoin stored on the trading platforms is not yours since these platforms could arbitrarily decide to block them or worse, get hacked as was the case with Mt. Gox in 2014.

If that happens, you will lose eventually all your Bitcoin.

As people become more knowledgeable, they realize that Bitcoin is much more than an investment. Bitcoin has broader social and economic implications for the world than traditional investments such as gold. Bitcoin represents a peaceful protest against a monetary and financial system that is no longer at the service of the people.

The examples of Venezuela and Argentina in Latin America already show the value of Bitcoin in enabling people to escape the bad political and economic decisions of corrupt politicians.

The timing of the first big drop in the price of Bitcoin helps to sort out the investors who will go further and those who will capitulate. Those who surrender at this point make a bad choice guided by fear. Everyone knows that fear is the enemy of winning investments. People who know how to control their emotions and who had bought Bitcoins in case they finally decide that they should continue to buy them and take advantage of the fear of others in the market.

Just in case, of course.

Step 6: Buy And Hold Bitcoin

Continuing to buy Bitcoin is tipping these people from the category of investors concerned about not missing out on a technological revolution in Bitcoiners’ 3-step strategy:

Buy BTC.

HODL BTC.

Repeat from Step 1.

Month after month, these people will therefore accumulate more and more BTC units and keep them safe within their hardware wallets. Time goes by, and the price of Bitcoin rises after falling. These up and down cycles are common, but these people are not afraid because HODLING Bitcoin has taught them the virtues of patience.

They’re becoming Bitcoin believers.

These people are developing growing confidence in Bitcoin. Many of them even become strong advocates ready to evangelize to their family and friends. Often, all this is a waste of time since everyone has to make his or her own way with Bitcoin before reaching the status of Bitcoiner in my opinion.

Step 7: Be A Bitcoiner

The final step in this adventure within the Bitcoin world is to become a Bitcoiner. You become certain that Bitcoin will establish itself in the future as an alternative to the current monetary and financial system that is flawed and not fixable.

Bitcoiner defends Bitcoin because it is certain that Bitcoin is building a fairer world for the future and it wants to be at the heart of this construction.

Being a Bitcoiner allows you to detach yourself from the day-to-day price of Bitcoin. Indeed, the current price of Bitcoin is nothing compared to what Bitcoin will bring to the world in the future.

Under these conditions, Bitcoiners don’t have any particular stress when they see the price of Bitcoin drop below $30,000 or even $4,000 as of March 2020. They know that Bitcoin will be even bigger in 10, 25, and 50 years.

In Bitcoin We Trust

Quora for all the questions you have on Bitcoin and Cryptocurrencies

Comment & Earn!

Share your thoughts and opinions on the topics covered within this blog in the comments below for your chance to win yourself an NFT. Click here for more information on our engagement rewards.

In Bitcoin We Trust Newsletter

In Bitcoin We Trust Newsletter